Since October 2023, the trading activity of institutional investors has increased. Luuk Strijers, Chief Business Officer of Deribit, stated that participants from traditional markets will become more involved in the crypto market in 2024.

Bitfinex analysts believe that the main catalyst for traditional financial institutions to participate more in the crypto market is the approval of Bitcoin spot ETFs. This will provide institutional investors with a regulated way to bet on the price of the world’s largest cryptocurrency.

Bitfinex analysts suggest that potential interest rate cuts in 2024 will encourage institutional investors to take risks. This increased preference for risky assets may ultimately affect Bitcoin. Bitfinex analysts added, “Interest rate cuts may make risky assets such as Bitcoin more attractive to institutional investors seeking higher returns in a low interest rate environment.”

According to Bitfinex, investors will be encouraged by more regulatory transparency in the coming year. Bitfinex analysts say that the most important aspect of regulatory transparency is the approval of Bitcoin spot ETFs, which will “provide a regulated and easier to obtain investment tool for retail and institutional investors.”

According to Glassnode’s recent analysis, the role of stablecoins in market dynamics has significantly changed compared to the previous cycle, and they have become the preferred quote currency for traders and the main source of market liquidity. In addition, October marked the first expansion of stablecoin supply since March 2022, which may be a sign of renewed investor interest.

According to PolkaWorld, Gavin Wood, co-founder of Polkadot, published his outlook for 2024 in the annual summary of Polkadot, stating that Polkadot will face a series of important developments and busy work in the new year, including four upcoming key infrastructure: agile Coretime, on-demand parallel chain Ethereum Snowbridge (bridge technology connecting Polkadot and Ethereum) and Kusama Bridge (technology connecting Polkadot and its sisters network Kusama). In addition, there is a fifth upcoming technology, namely elastic expansion, which is expected to be implemented in 2024.

Impacted by favorable factors, according to Gate.io market data, DOT price once rose above the $9.5 mark, directly pointing to $10, and is now reported at $9.38, with a 24-hour increase of 7.6%.

In terms of market fluctuations of other popular tokens, the intraday gains of ORDI and 1000SATS were 44.77% and 41.58%, respectively. According to Gate.io’s market data, ORDI price briefly broke through $78 and is now trading at $76.12. 24-hour increase of 44.77%; 1000SATS once rose to $0.000889 and is now reported at $0.0008717, a 24-hour increase of 41.58%.

According to DeBank data, Blur founder Pacman’s Layer 2 network Blast contract address currently holds a total asset value of over $1 billion, reaching $1.03 billion. Approximately $918 million worth of ETH was deposited into the Lido protocol, and $107 million worth of assets were deposited into the Maker protocol.

In addition, Sui’s network TVL has also exceeded $200 million, reaching a historic high. Since September 2023, its network TVL has grown by nearly 500%.

In terms of NFT, Cryptoslam.io data shows that NFT transaction volume decreased by 12.26% last week, totaling $463.87 million. Last week, the number of NFT buyers increased by 72.05% and the number of sellers increased by 56.61%.

Despite a decrease of 13.71% from the previous week, NFTs on the Bitcoin chain still ranked first with a weekly transaction volume of $265.61 million, accounting for 57.25% of all NFT transactions last week. Solana‘s on chain NFT trading volume ($88.42 million) rose to second place, while Ethereum’s on chain NFT weekly trading volume ($75.91 million) fell to third place.

Among the top ten major NFT series in terms of transaction volume in the past week, 9 came from the Bitcoin chain. The Solana NFT series Open Solmap ranks fifth in weekly transaction volume ($1.04 million) on the chain.

Although the trading volume has slowed down, the token market in the blockchain game sector has shown a general upward trend. According to market data, there has been a general upward trend in blockchain gaming tokens, with AXS experiencing a 24-hour increase of 30.31% and currently offering a price of $10.5; MBOX has a 24-hour increase of 23.03% and is currently quoted at $0.4; AGLD has a 24-hour increase of 19.44%, and is currently quoted at $1.446; VOXEL’s 24-hour increase reached 13.32%, and the current quotation is $0.2438; The 24-hour increase in SLP is 11.68%, and the current quotation is $0.0035.

Compared to the $33.3 billion invested in 2022, crypto venture capital in 2023 plummeted by 68% to $10.7 billion. Nevertheless, the total investment in 2023 still exceeds the previous bear market, surpassing the $6.4 billion investment in 2019 and 2020. The majority of investments occurred in the first half of the year, with a slight decrease in the second half, despite an increase in investments in November.

It is worth noting that the proportion of transactions allocated to pre seed, seed, and A-round startups in 2023 has increased, while transactions in the mid to late stages have decreased compared to the previous year. Despite the economic slowdown in 2023, the total investment for the year still exceeded the previous bear market. The investment amount from 2019 to 2020 was $6.4 billion.

The number of crypto venture capital transactions has also slowed down in 2023. There were a total of 1819 transactions in this year, a 32% decrease from 2671 in 2022. Overall, the trading volume in 2023 continued to be higher than the monthly trading volume in 2020 and approached the trading volume in 2021. From the distribution of stage investments, most of the funds will Flow to pre seed, seed, and pre A-round startups in 2023, while the activity of mid to late-stage startups is relatively low, which is consistent with the trend in 2022.

Main Token Trends

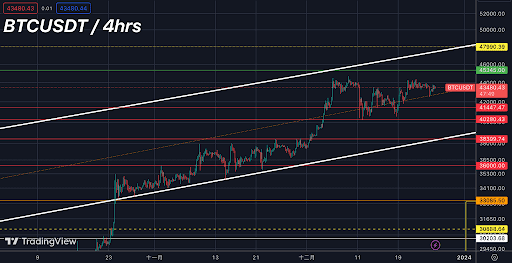

BTC

Last week closed above $42,500, and this morning it continues to test the mid-channel axis. This week is expected to test two resistance targets: $45,345 and $47,990. Bitcoin price support remains strong at $40,280 and $38,399, indicating a continued high-level oscillation in the medium term.

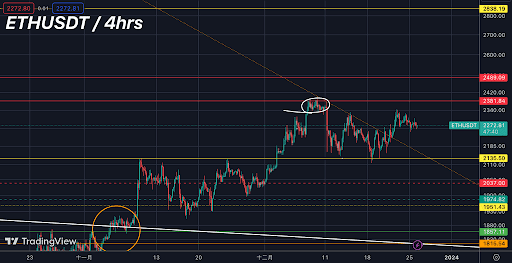

ETH

In the short term, a four-hour descending triangle trend is observed. Attention is advised to the short-term high resistance of $2,381. A breakthrough may lead to an upward price movement towards $2,489 and $2,838 for Ethereum. Failure to do so could result in a retest of the support at $2,135. Long-term outlook remains bullish.

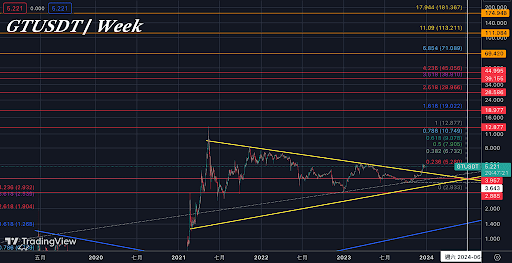

GT

The weekly chart signals the beginning of the second phase of a bull market. Short-term support is at the white line, while the long-term price support for GateToken converges around $2.88. Anticipating an early upward movement in the platform currency sector, target prices are set at $12.877, $18.977, $28.58, and $44.99. Long-term holding is recommended.