-

Table of Contents

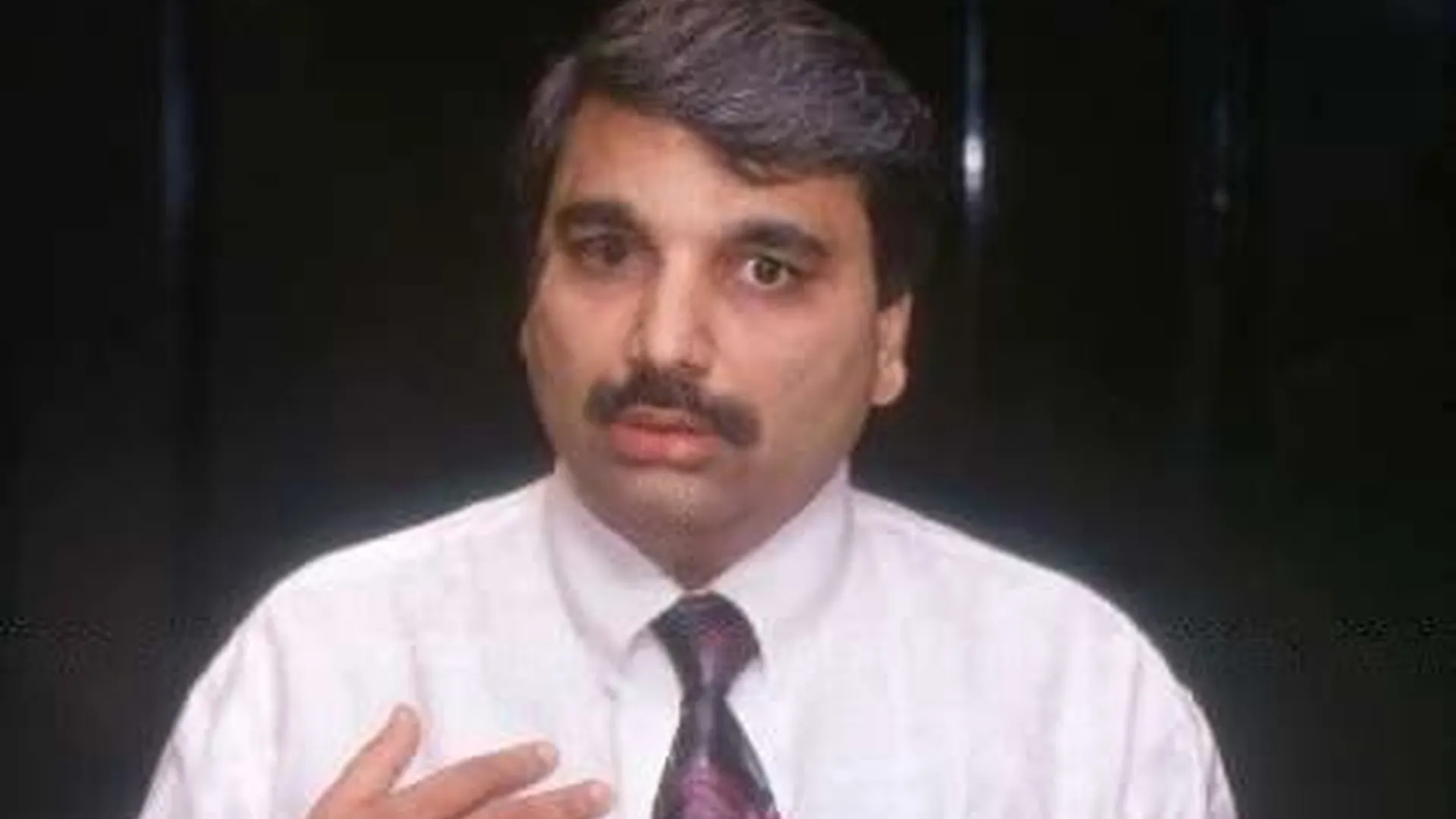

The Rise and Fall of Harshad Mehta: A Tale of Financial Manipulation

Introduction:

Harshad mehta, also known as the “Big Bull,” was a prominent Indian stockbroker and businessman who rose to fame in the late 1980s and early 1990s. His meteoric rise in the stock market and subsequent downfall captivated the nation and left a lasting impact on India’s financial landscape. In this article, we will delve into the life and times of Harshad mehta, exploring his strategies, the consequences of his actions, and the lessons learned from this infamous chapter in Indian financial history.

The Early Years and Entry into the Stock Market

Harshad mehta was born on July 29, 1954, in a middle-class Gujarati family in Mumbai, India. He started his career as a small-time broker in the Bombay Stock Exchange (BSE) in the late 1970s. Mehta’s early years in the stock market were marked by perseverance and a hunger for success. He quickly gained a reputation for his sharp wit and ability to spot lucrative investment opportunities.

Mehta’s breakthrough came in the late 1980s when he discovered a loophole in the banking system that allowed him to exploit the interbank transactions. He realized that banks were not required to maintain a 100% cash reserve against the funds they received from the Reserve Bank of India (RBI). This revelation became the foundation of his infamous “Ready Forward (RF) Deal” strategy.

The Ready Forward (RF) Deal Strategy

The RF deal strategy involved borrowing money from one bank and using the funds to buy shares in another bank. Mehta would then use these shares as collateral to borrow more money from other banks, creating a chain of transactions. This process artificially inflated the stock prices of the targeted banks, allowing Mehta to make substantial profits.

Mehta’s RF deal strategy was highly successful, and he quickly became one of the most influential players in the Indian stock market. His actions led to a significant bull run in the stock market, with the benchmark index, the BSE Sensex, soaring to unprecedented heights. Mehta’s rise to power and his extravagant lifestyle made him a symbol of success and wealth in India.

The Scam Unveiled: The Fallout and Legal Battle

Mehta’s empire came crashing down in 1992 when journalist Sucheta Dalal exposed his fraudulent activities in a series of articles published in the newspaper “The Times of India.” The exposé revealed the magnitude of Mehta’s financial manipulation and sent shockwaves throughout the country.

The Securities and Exchange Board of India (SEBI), the regulatory body responsible for overseeing the Indian securities market, launched an investigation into Mehta’s activities. The investigation uncovered a web of deceit, with Mehta involved in numerous illegal activities, including price manipulation, insider trading, and forging documents.

In 1992, Mehta was arrested and charged with multiple offenses, including cheating, forgery, and criminal conspiracy. The legal battle that followed was highly publicized and drew immense attention from the media and the public. Mehta’s defense team argued that his actions were a result of loopholes in the system and that he was merely exploiting them. However, the court found him guilty, and he was sentenced to five years in prison.

The Aftermath and Lessons Learned

The Harshad mehta scam had far-reaching consequences for India’s financial system. It exposed the vulnerabilities and loopholes in the banking and regulatory systems, leading to significant reforms and changes in the Indian stock market.

One of the most significant outcomes of the scam was the establishment of the National Stock Exchange (NSE) in 1994. The NSE introduced electronic trading, bringing transparency and efficiency to the stock market. It also implemented strict regulations and surveillance mechanisms to prevent market manipulation and fraud.

The Harshad mehta scam also highlighted the importance of investor education and awareness. Many individuals were lured by Mehta’s success and invested their hard-earned money without fully understanding the risks involved. The incident served as a wake-up call for investors, prompting them to become more cautious and informed about their investment decisions.

Conclusion

The rise and fall of Harshad mehta remains one of the most captivating stories in Indian financial history. Mehta’s ability to manipulate the stock market and his subsequent downfall exposed the weaknesses in the banking and regulatory systems. The reforms that followed the scam brought about significant changes in the Indian stock market, ensuring greater transparency and investor protection. The lessons learned from this episode continue to shape India’s financial landscape, reminding us of the importance of integrity, accountability, and investor education.

Q&A:

- Q: What were the key factors that contributed to Harshad Mehta’s rise in the stock market?

A: Harshad mehta‘s rise in the stock market can be attributed to his discovery of the loophole in the banking system, which allowed him to exploit interbank transactions. His sharp wit, ability to spot lucrative opportunities, and the success of his Ready Forward (RF) deal strategy also played a significant role.

2. Q: How did Harshad Mehta manipulate stock prices?

A: Harshad mehta manipulated stock prices by artificially inflating them through his RF deal strategy. By borrowing money from one bank and using it to buy shares in another bank, he created a chain of transactions that drove up the stock prices of the targeted banks.

3. Q: What were the consequences of the Harshad Mehta scam?

A: The Harshad mehta scam had far-reaching consequences. It exposed the vulnerabilities in the banking and regulatory systems, leading to significant reforms in the Indian stock market. It also highlighted the importance of investor education and awareness.

4. Q: How did the Indian stock market change after the Harshad Mehta scam?

A: The Harshad mehta scam led to the establishment of the National Stock Exchange (NSE) in 1994, which introduced electronic trading and implemented strict regulations and surveillance mechanisms. These changes brought transparency and efficiency to the stock market.

5. Q: What lessons can be learned from the Harshad Mehta scam?

A: The Harshad mehta scam highlighted the importance of robust regulatory systems, investor education, and awareness. It serves as a reminder to investors to be cautious and well-informed about their investment decisions.